Accounting Software

S A WEBSOFT provide to Business Accounting Software. Accounting software describes a type of application software that records and processes accounting transactions within functional modules such as accounts payable, accounts receivable, payroll, and trial balance. It functions as an accounting information system.

-

Super Admin Login

- User Id : superadmin Password : superadmin

The price is on, Please Call +880 1918 340 047

Or Email Us for a detailed proposal at: sawebsoft@gmail.com

You can call us or meet us at our office anytime regarding your campaign, suggestions and marketing consultancy for FREE!

Manage Accounting Software(Super Admin)

- Admin User Manage.

- Dollar Conversion Rate.

- Yearly Tax Manage.

- Chart of Account.

- General Ledger Manage.

- Subsidiary Ledger Manage.

- Change Password Manage.

Accounts Setup :

- Commission Entry.

- Paid Up Transaction.

- Depreciation Calculation.

- Income Statement View.

- Monthly Income Statement Create.

- Yearly Income Statement Create.

- Received Transaction.

- Balance Sheet View.

- Monthly Balance Sheet Create.

- Yearly Balance Sheet Create.

Accounts Manage :

- Commission Report.

- Depreciation Report.

- Expense Report Subsidiary Ledger.

- Income Report Date Wise.

- Income Report Subsidiary Ledger.

- Expense Report Date Wise.

Accounts Report :

- General Ledger Report.

- Subsidiary Ledger Date Wise Report.

- General Ledger Date Wise Report.

- Yearly Income Statement Report.

- Trial Balance.

- Yearly Balance Sheet Report.

- Subsidiary Ledger Report.

- Monthly Income Statement Report.

- Monthly Balance Sheet Report.

Final Report :

Manage Accounting Software(Admin)

- Chart of Account.

- General Ledger Manage.

- Subsidiary Ledger Manage.

Accounts Setup :

- Commission Entry.

- Paid Up Transaction.

- Depreciation Calculation.

- Income Statement View.

- Monthly Income Statement Create.

- Yearly Income Statement Create.

- Received Transaction.

- Balance Sheet View.

- Monthly Balance Sheet Create.

- Yearly Balance Sheet Create.

Accounts Manage :

- Commission Report.

- Depreciation Report.

- Expense Report Subsidiary Ledger.

- Income Report Date Wise.

- Income Report Subsidiary Ledger.

- Expense Report Date Wise.

Accounts Report :

- General Ledger Report.

- Subsidiary Ledger Date Wise Report.

- General Ledger Date Wise Report.

- Yearly Income Statement Report.

- Trial Balance.

- Yearly Balance Sheet Report.

- Subsidiary Ledger Report.

- Monthly Income Statement Report.

- Monthly Balance Sheet Report.

Final Report :

Facilities of Accounting Software

Dollar Conversion Rate : Dollar Conversion rate easily through transfers money to dollar and dollar to money.You can successfully access converting system.Sending your money couldn't be easier, whether you need regular transfers or as a single transaction will convert your Dollars to money the fastest way and reduce the time it takes for your money to arrive.

Yearly Tax Manage : Taking advantage of tax-deferred accounts is a key step in building a tax strategy. You may have more opportunities for tax efficiency by being strategic about the accounts you use to hold the investments that generate the most taxes, choosing investments that may create less of a tax burden, and taking advantage of tax deductions to reduce your overall bill.When considering taxes and investment selection, it is important to remember that old adage. That’s because taxes are an important factor in an investing strategy, but they certainly aren’t the only factor. The potential tax benefits of any strategy need to be viewed in the context of your overall investing plan.There are some choices that can have a potential impact on your tax bill.

Chart of Account : A chart of accounts is a list of accounts used by a business to classify financial transactions. In Mysql E-Business Suite (EBS), the chart of accounts is called the accounting flexfield and is one example of a number of key flexfields in EBS that store values in a table structure for integration with other parts of the enterprise resource planning system. A good chart of accounts provides flexibility for recording and reporting accounting information, provides structure for managing business uniformly, and enhances communication across all parts of the business. A great chart of accounts takes care and consideration in the design phase, with particular focus on five key criteria considerations that will maximize the life of the accounting flexfield.Chart of accounting by you can win most important four system.They are property of assets,liability & capital,income statement and expense.Then you can manage all property variant system.The primary purpose of the General Ledger is financial reporting and financial analysis. The Chart of Account structure defines the nature, ranges, and groupings of information available for reporting and inquiry. Reporting is generated by ranges and groupings of values for one or more segments. Management must define the dimensions by which financial data will be analyzed and reported and ensure those dimensions are reflected in the segments contained within the COA structure.

General Ledger Code Manage : General Ledger is a comprehensive financial management solution that provides highly automated financial processing,effective management control, andreal-time visibility to financialresults. It provides everything you need to meet financialcompliance and improve your bottom line. Mysql General Ledgeris part of the Mtsql E-Business Suite, an integrated suite ofapplications that drive enterprise profitability, reduce costs,improve internal controls and increase efficiency.General Ledger reports help you track the financial status of your business on a day-to-day basis to help you make smart business decisions. In addition, the reports provide documents that creditors, banks, and the Internal Revenue Service accept as credible business documentation. Several different report types are available, such as Financial Reports, Budget Review Reports, and Reference Reports.

Subsidiary Ledger Code Manage : Accounting for all transactions uses Oracle Subledger Accounting (SLA). SLA delivers many benefits, and lets you customize the way accounting is performed for a specific event. You can use accounts derived from custom business logic based on data provided by the application (accounting sources).Principles of Accounts Measure Financial Performance and Position that the use of subsidiary ledgers offers three primary benefits. For example, the aggregation of transaction data in subsidiary ledgers, rather than the general ledger control accounts, enables management's easy access to line-item data pertaining to a particular financial statement entry. In addition, the use of both subsidiary ledgers and general control accounts provides a means to confirm the accuracy of the entries in the subsidiary ledgers through a reconciliation of the subsidiary ledgers balances to the general ledger balances. The recording of individual business transactions in subsidiary ledgers in addition to the general ledger also provides the option to review either summarized or detailed information regarding specific categories of business transactions.

Income Report Date Wise & Subdiary Ledger Wise : The income statement is a financial report that shows an entity's financial results over a specific time period. The time period covered is usually for a month, quarter, or year, though it is possible that partial periods may also be used. This is the most commonly-used of the financial statements, and is the most likely to be distributed within a business for management review.Then you can successfully view all income and subdiary ledger report.

General Ledger Report : A general ledger (GL) is a chronological accounting record a business uses to keep track of financial transactions. Transactions are categorized and summarized into accounts. An account is a unique record for each type of asset, liability, equity, revenue and expense. The number and type of accounts that make up the general ledger is determined by the chart of accounts (COA). Then you can view all report date wise in this software.

Subsidiary Ledger Report : A Subsidiary ledger reportis a book or database in which double-entry accounting transactions are stored or summarized. A subsidiary ledger is a ledger designed for the storage of specific types of accounting transactions.Once information has been recorded in a subsidiary ledger, it is periodically summarized and posted to an account in the general ledger, which in turn is used to construct the financial statements of a company. The account in the general ledger where this summarized information is stored is called a control account. Most accounts in the general ledger are not control accounts; instead, individual transactions are recorded directly into them.Then you can view all report date wise in this software.

Change Password : Avatier Password Station allows your employees to securely reset their own forgotten password in a matter of seconds from anywhere or anytime using a web browser or Avatier's automated telephone system without calling the help desk.By reducing help desk calls your organization will save a significant, and easily measurable, amount of money. Furthermore, Avatier Password Station does not require an army of consultants to deploy.Then you can easily change password.

Commission Entry & Report : Commission Entry is Sales data received from manufacturers in the form of invoice copies, commission statements or sales summary reports is quickly and easily entered into database. User-friendly data entry screens simplify daily entry of data, and more importantly, eliminates processing.Then you can suceessfully view commission report.

Paid Up Transaction : A paid up transaction is an agreement, communication, or movement carried out between a buyer and a seller to exchange an asset for payment. It involves a change in the status of the finances of two or more businesses or individuals. The buyer and seller are separate entities or objects, often involving the exchange of items of value, such as information, goods, services, and money. It is still a transaction if the goods are exchanged at one time, and the money at another. This is known as a two-part transaction: part one is giving the money, part two is receiving the goods.

Received Transaction : A receive transaction processing system is a computer database system that balances and controls purchases of goods and services within a business network. A common example may be a consumer purchasing a product on an online store. The transaction processing system coordinates the warehousing and distribution of the item, the credit and bank transaction from the consumer's payment account and the business's management of inventory, sales, profits and payroll. This complex system has many advantages.

Depreciation Calculation & Report : Depreciation reports are a key component to planning your contingency reserve funds. Understanding where and when maintenance is required is the foundation to smart financial decision-making. Advance knowledge of maintenance costs will allow councils to plan for the future and reduce the impact of unexpected costs that often trigger special levies on individual suite owners.Then you can suceessfully view Depreciation report.

Income Statement View : An income statement view presents the results of a company's operations for a given reporting period. Along with the balance sheet, the statement of cash flows, and the statement of changes in owners' equity, the income statement is one of the primary means of financial reporting. It is prepared by accountants in accordance with accepted principles. The income statement presents the revenues and expenses incurred by an entity during a specific time period, culminating in a figure known as net income. A company's net income for an accounting period is measured as follows: Net income Revenues Expenses Gains Losses.

Income Statement Create for Business Monthly & Year : The income statement is considered by many to be a company's most important financial statement. It discloses the dollar amount of the profitability for a company during a specific period of time. Since published annual financial statements usually cover a 12-month period or monthly, which will be the assumption here. The heading of the income statement should contain three crucial elements of information: the name of the company involved, the title of the statement identifying it as an income statement, and the specific 12-month period during which the income was earned. The basic format of the income statement is represented by the following equation: revenues minus expenses equal net income.This works you can access easily by our demo software.

Balance Sheet Create, View for Monthly and Yearly : A balance sheet reports the assets, liabilities, and owner’s equity at a specific date view.Presentation of liabilities.The balance sheet is a snapshot of the company’s financial condition at a specific.moment in time (usually the month-end or year-end).balance sheet from the column headings of the tabular summary and the month-end data shown in its last line.Observe that the balance sheet lists assets at the top, followed by liabilities andowner’s equity.Total assets must equal total liabilities and owner’s equity. Softbyte reports only one liability—accounts payable—in its balance sheet. In most cases,there will be more than one liability.

Expense Report Date Wise & Subdiary Ledger Wise : Expense report software is a computer program or suite that provides enterprise administrators with a clear picture of the organization's spending through automated analytics and reporting.Expense report software is a computer program or suite that provides enterprise administrators with a clear picture of the organization's spending through automated analytics and reporting.Then you can sueecssfully view Subdiary Ledger Report.

Income Statement Business Report Monthly and Yearly : A income report main accounting records. A general ledger is a complete record of financial transactions over the life of a company. The ledger holds account information that is needed to prepare financial statements, and includes accounts for assets, liabilities, owners' equity, revenues and expenses.Then you can view all income report monthly and yearly.

Balance Sheet Report Monthly and Yearly : A balance sheet reports the assets, liabilities, and owner’s equity at a specific date.Though a balance sheet is formally required for most small business reports or even taxes, it can be helpful in determining the overall health of a company. Without an understanding of basic accounting principles, it may be overwhelming to think of creating a balance sheet or any other financial report. However, balance sheets can be quite simple for a small business owner to create and can even be generated automatically by most online or traditional accounting software.Then you can view all balance sheet report date wise.

Trial Balance : Trial balance is a list of accounts and their balances at a given time.Customarily, companies prepare a trial balance at the end of an accounting period. They list accounts in the order in which they appear in the ledger.Then you can view report date wise.It ensures that the transactions recorded in the books of accounts have identical debit and credit amount. Balance of each ledger account has been computed correctly. Balance of each and every ledger account has been transferred accurately and on the correct side of the sheet on which trial balance has been prepared. The debit and the credit columns of trial balance have been added up correctly.This is the traditional trial balance report. Use this report for clients for whom you don't make adjusting journal entries, or when you want to modify or memorize the report or perform any other standard report operation.

User Guide of Accounting Software Access

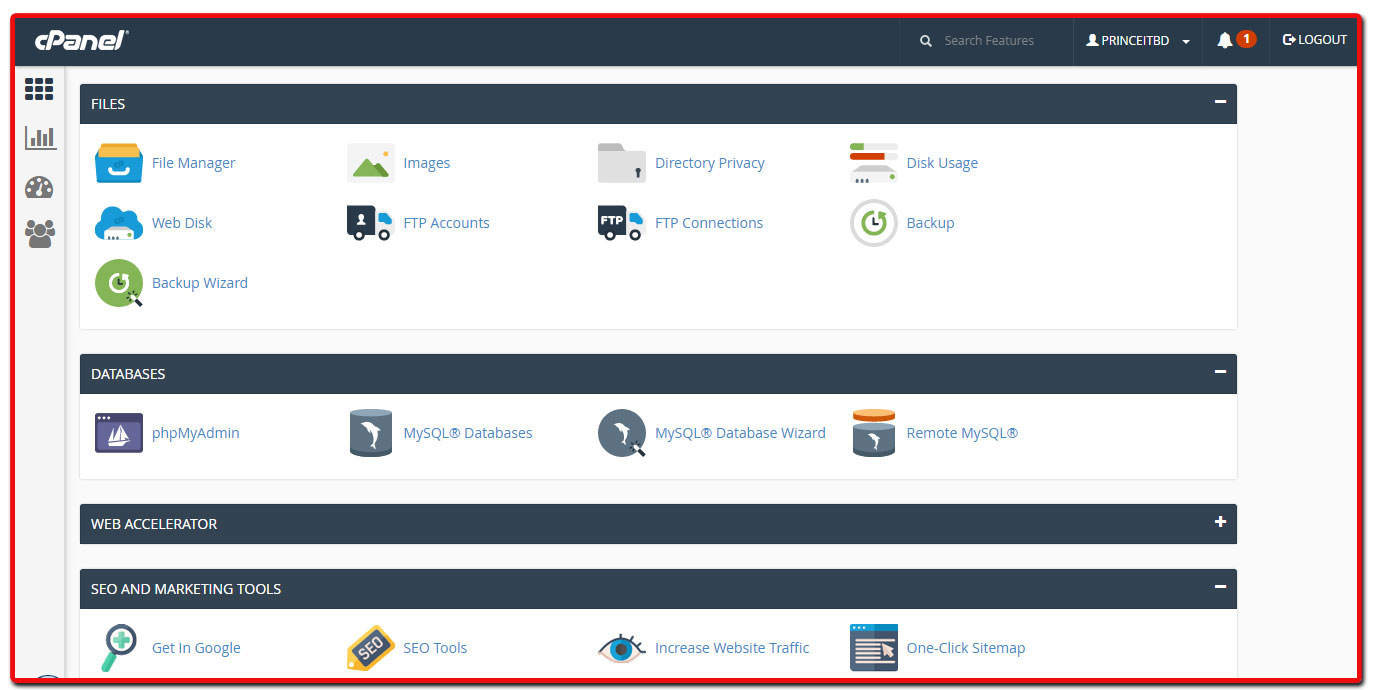

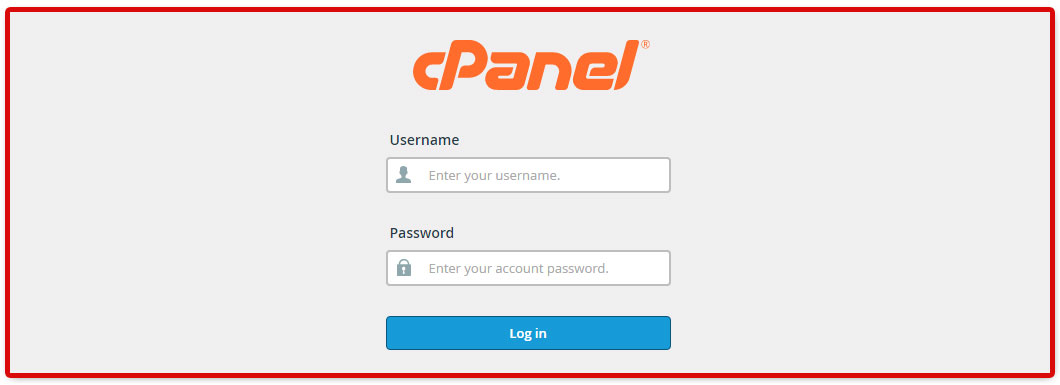

Step-1 : When you purchase domain & hosting.Please login your cpanel. By your domain user name and password .

Login process : Write your domain address on the search bar ,Then you will look a cpanel like that picture.Now put your user name & password, then click the login button.

Step-2 : On this step you get a page ,like as picture.Please click the (File Manage ) folder , then you can see some extra file please delete all file. Then you can upload your Zippe- file.

Upload Process : Click upload folder from top menu, you will get a browse option and click this button,select your file and wait,upload 100% complete.Please refresh your address bar, then you can see zippe-file extract it.Now move all file your domain public html.When completed move all file,then please back to home page like as picture.

Create database process : Now you can see (Mysql database) folder,and click this folder, then create_database & user namethen you can see (add user to database ) then select user name and database click add button,click all privileges check box .Click(make change) then go back home.

Database import process : Click php( My Admin) folder select database and click import button then click browse button and select your database file click go button.